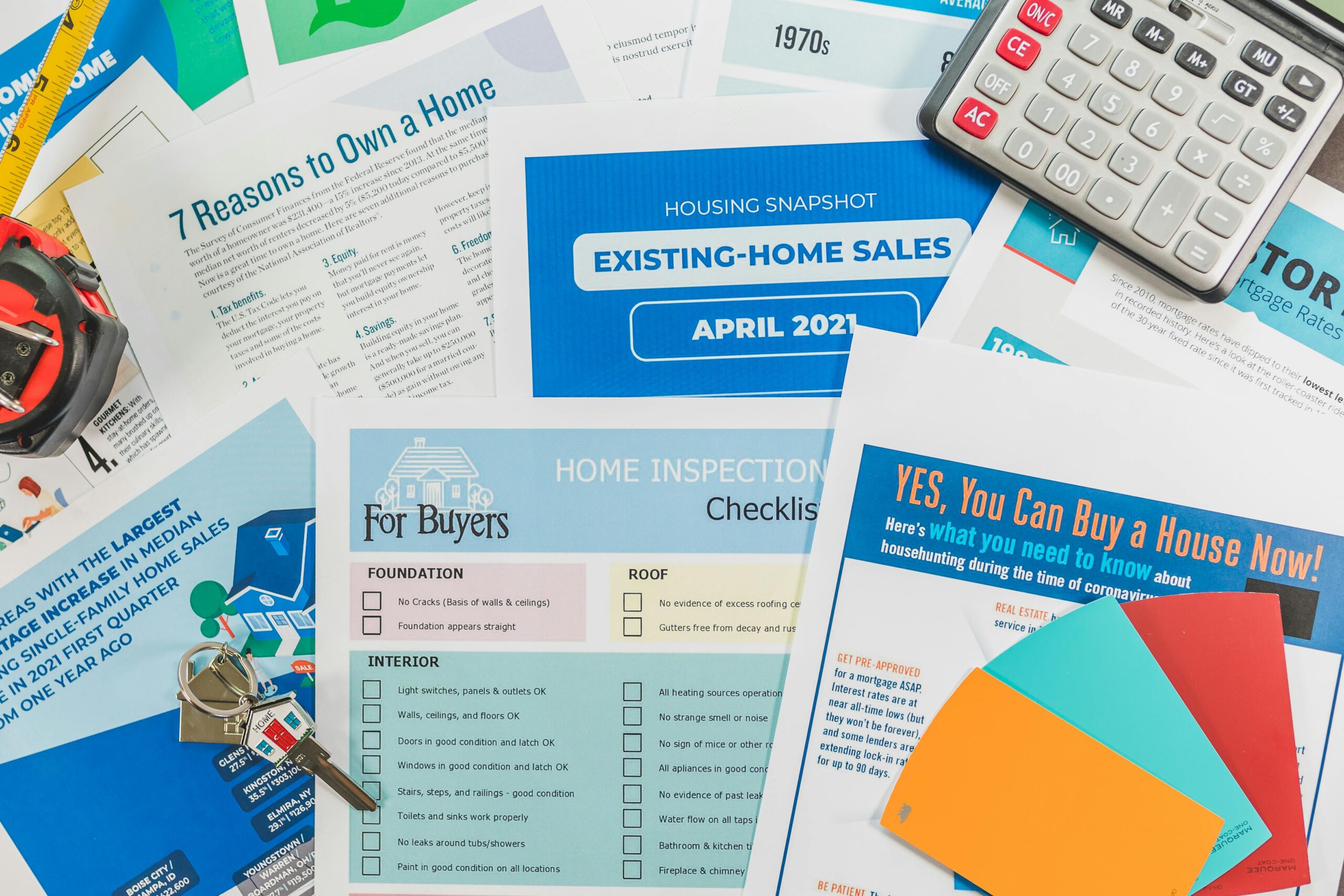

Buying a home in Las Vegas is an exciting step, but it often comes with nerves, especially when you are trying to make sense of shifting prices, competitive demand, and local trends. Many buyers wonder whether they are choosing the right home at the right time. With each neighborhood in Las Vegas behaving differently, it is easy to feel overwhelmed.

That is where a strong approach to real estate market analysis becomes essential. Understanding how to evaluate pricing trends, demand patterns, and neighborhood dynamics empowers you to move forward with clarity. National reporting from Forbes also highlights how buyer preferences, migration trends, and rate fluctuations influence markets like Las Vegas, making local analysis even more valuable.

By the end of this guide, you will have a clear, practical process for analyzing the Las Vegas real estate market so you can buy a home in Las Vegas with confidence.

Why Real Estate Market Analysis Matters for Las Vegas Buyers

A thorough market analysis helps you make data-driven decisions. Las Vegas grows quickly, shifts rapidly, and experiences major changes in inventory levels throughout the year. Without analysis, buyers risk overpaying or missing strong opportunities.

Smart analysis helps you:

- Understand if the las vegas housing market favors buyers or sellers

- Compare home values across las vegas neighborhoods

- Predict upcoming pricing trends

- Make strategic offers based on real numbers, not emotion

The better your understanding of the las vegas real estate landscape, the easier it becomes to identify the right home at the right price.

Understanding Key Market Factors

Start by evaluating the core forces that influence pricing.

Inventory levels:

High inventory gives buyers negotiating power, while low inventory strengthens sellers.

Mortgage rate trends:

Higher rates reduce buyer activity, while lower rates increase competition.

Seasonal patterns:

Spring and early summer often see more movement in Las Vegas.

Median price trends:

Analyze whether pricing is rising, stabilizing, or adjusting downward.

Track:

- month-over-month price shifts

- average days on market

- price-per-square-foot changes

These signals help you understand the direction of the las vegas real estate market and identify the right time to act.

Evaluating Local Pricing Patterns

Las Vegas neighborhoods vary dramatically. Summerlin, Henderson, and North Las Vegas often have different buyer pools, inventory levels, and appreciation patterns.

Review recent comparable sales to understand actual market behavior. Look for:

- similar square footage

- similar home age and condition

- sales within the last 3 to 6 months

- homes within a 0.5 to 1 mile radius of your target area

Compare listing price to sold price, and evaluate price-per-square-foot trends to ensure you are not overpaying.

Platforms with curated las vegas real estate listings and personalized search tools such as local home search services can make neighborhood-level pricing easier to evaluate.

Interpreting Buyer Demand Signals

Demand is the heartbeat of all real estate markets. These indicators reveal whether competition is rising or easing:

- multiple-offer situations

- fast-moving listings

- rising pending sales volume

- decreasing rental vacancies

- active new-construction growth nearby

Understanding buyer urgency helps you decide whether to offer aggressively or strategically wait. In highly competitive pockets, working with top real estate agents Las Vegas buyers trust can give you an advantage during negotiations.

Real-World Examples of Applying Market Analysis

When reviewing homes for sale Las Vegas, your analysis may lead to different strategies:

Example 1: Competitive market like Summerlin

Shrinking inventory and rising price-per-square-foot data indicate that strong offers are needed quickly.

Example 2: Balanced market in North Las Vegas

Longer days on market and modest price adjustments may allow room for negotiation.

Example 3: Investment-focused markets

Steady rental demand and lower vacancy rates create appealing opportunities for long-term investors.

In each case, analysis ensures you are not guessing and instead acting with confidence.

Best Practices to Strengthen Your Buying Strategy

- Compare multiple data sources

Use MLS data, neighborhood reports, and local expert commentary. - Analyze long-term trends

Review 3, 6, and 12 months of pricing activity. - Track upcoming infrastructure projects

New developments can increase long-term home value. - Work with a knowledgeable team

Partnering with galindo group real estate las vegas or similar experts helps you identify microtrends before they hit the general market. Their real estate team can help refine your strategy. - Balance data with lifestyle needs

Market numbers guide decisions, but daily-life fit ensures long-term satisfaction.

If you plan to improve a property after purchase, renovation support can help boost home value and functionality.

Final Thoughts on Buying a Las Vegas Home With Confidence

A well-executed real estate market analysis gives you clarity, predictability, and confidence. Understanding pricing trends, buyer demand, and neighborhood shifts is the key to making a smart investment in the Las Vegas housing market.

When you are ready to take the next step, working with experienced las vegas real estate agents helps turn analysis into action. For hands-on support, start with a tailored home search service or explore client reviews to see how other buyers succeeded.

Frequently Asked Questions

1. How do I know if it is the right time to buy a home in Las Vegas?

Review mortgage rates, inventory levels, and recent pricing trends. Rising inventory and stabilizing prices often favor buyers.

2. What data is most important in a Las Vegas market analysis?

Median home prices, price-per-square-foot, days on market, and comparable sales.

3. Can first-time buyers perform their own analysis?

Yes. Beginners can gather valuable data online, but partnering with an expert ensures correct interpretation.

4. How competitive is the Las Vegas housing market?

It varies widely. Some neighborhoods see fast-moving listings, while others offer more negotiation room.

5. What mistakes should buyers avoid?

Avoid relying on outdated data, focusing on list price instead of sold price, and ignoring neighborhood-level patterns.